inheritance tax calculator florida

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. The federal estate tax only.

Maryland Inheritance Tax Calculator Probate

Florida Estate Tax.

. Be sure to file the following. When considering both state and local rates sales taxes in Florida are pretty close to the national average. Some people are not aware that there is a difference.

For example your father dies and leaves you his property worth 500000. Inheritance Tax Calculator Florida. A federal change eliminated Floridas estate tax after December 31 2004.

Our Inheritance Tax Calculator is designed to work out your potential inheritance tax IHT liability. The receipt of the property is not for income tax purposes because in Florida inherited assets are. 45 percent on transfers to direct descendants and lineal heirs.

A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000. Your average tax rate is 1198 and your marginal. The statewide rate is 6 and the average total rate including local taxes is 701.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. SmartAssets Florida paycheck calculator shows your hourly and salary income after federal state and local taxes. Enter your info to see your take home pay.

You can contact us at arnold law to explore your options for navigating the estate and inheritance process. Previously federal law allowed a credit for state death taxes on the federal estate tax. Some people are not aware that there is a difference.

If an inheritance is greater than 117 million only the amount over 117 million will be subject to the federal estate tax. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or. The tax rate varies depending on the relationship of the heir to the decedent.

The size of the estate tax exemption means very. The federal estate tax exemption for 2021 is 117 million. The estate tax exemption is adjusted for inflation every year.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt. Their federal estate tax exemption is. Inheritance Tax Calculator Florida.

Heres a breakdown of each states inheritance tax rate ranges. If an inheritance is greater than 117 million only the amount over 117 million will be subject to the federal estate tax. How Much Is the Inheritance Tax.

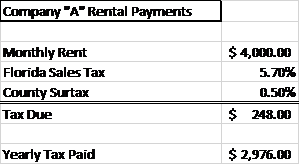

How To Calculate Fl Sales Tax On Rent

Inheritance Tax Calculator Hargreaves Lansdown

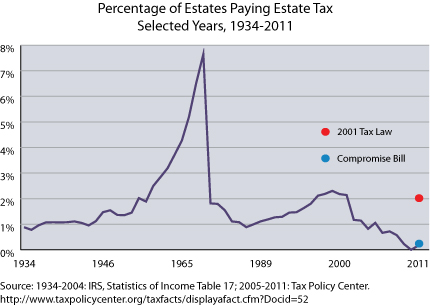

Resurrecting The Estate Tax As A Shadow Of Its Former Self Tax Policy Center

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Inheritance Tax Who Why How Internal Revenue Code Simplified

:max_bytes(150000):strip_icc()/beautiful-old-couple-619409150-d7a3f4b5f2874a55a0195b8c53d9d3b9.jpg)

Calculating Your Potential Estate Tax Liability

Florida Income Tax Calculator Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Tax Everything You Need To Know Smartasset

Florida Income Tax Calculator Smartasset

Mathing Out Estate Tax Planning Strategies

Estate Tax In The United States Wikipedia

![]()

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Florida Property Tax Calculator Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning